The Midas Touch: Unveiling the Allure and Perils of Gold Investment

Gold has been a coveted asset for centuries, capturing the attention of investors seeking to safeguard their wealth while diversifying their portfolios. However, the world of gold investment is not without its intricacies and potential pitfalls. This comprehensive guide aims to illuminate the advantages and disadvantages of gold investment, empowering you to make informed decisions about incorporating this precious metal into your financial strategy.

Throughout this guide, we will explore the role of gold in asset allocation, delving into its historical performance and factors influencing its price fluctuations. We will also examine the various ways to invest in gold, from physical bullion to gold-backed securities. Whether you’re a seasoned investor or new to the allure of gold, this guide will provide you with the knowledge and insights you need to navigate the gold market with confidence.

Are you ready to embark on a journey into the golden realm of investment? Join us as we unravel the secrets of gold’s potential and the considerations that go hand in hand with investing in this timeless asset.

Key Insights: Gold Investment

5 Key Points

- Gold can be a valuable addition to a diversified investment portfolio. It offers potential benefits such as diversification, inflation protection, and a safe haven during market downturns.

- Gold’s price is influenced by various factors, including economic and political events, supply and demand dynamics, and central bank actions.

- There are different ways to invest in gold, including physical gold, gold ETFs, and gold futures. Each method has its advantages and risks.

- Gold investments are not without risks. Price volatility, storage costs, and liquidity concerns should be considered before investing.

- Diversification strategies with gold can help manage risk and potentially enhance returns over the long term.

1. Understanding Gold’s Role in Asset Allocation

Understanding Gold’s Role in Asset Allocation

In the realm of investing, the concept of asset allocation stands tall. It’s like spreading your eggs across different baskets, ensuring that your financial fortunes aren’t tied to the fate of a single asset class. Gold, with its unique characteristics, has traditionally played a pivotal role in asset allocation strategies.

Gold is often viewed as a safe haven asset, a sanctuary during financial storms when other investments might be faltering. Its price tends to move independently of stocks and bonds, offering potential diversification benefits. By adding gold to your portfolio, you’re not putting all your eggs in one basket; you’re creating a more resilient investment strategy.

Another feather in gold’s cap is its potential to hedge against inflation. When the cost of living rises, the value of gold tends to follow suit, providing a potential buffer against the erosive effects of inflation. This makes gold an attractive option for investors seeking to preserve the purchasing power of their wealth over the long term.

2. Advantages of Gold Investment

Advantages of Gold Investment

Investing in gold comes with a unique set of advantages that have made it a popular choice for investors for centuries. Let’s dive into the key benefits that make gold an attractive asset:

Safe Haven Asset: Gold has a reputation as a safe haven asset, a beacon of stability in times of economic turmoil. When stock markets plunge and bonds falter, investors often flock to gold as a perceived store of value. This flight to safety can buoy gold’s price, offering potential protection for your portfolio during periods of market volatility.

Inflation Hedge: Gold has a knack for holding its value, even when the cost of living rises. Historically, gold’s price has tended to track inflation, providing a potential hedge against the erosive effects of inflation on your purchasing power. By incorporating gold into your portfolio, you may be able to preserve your wealth’s real value over the long term.

Portfolio Diversification: Gold’s price movements often differ from those of stocks and bonds, making it a valuable tool for portfolio diversification. By adding gold to your investment mix, you can potentially reduce your portfolio’s overall risk and enhance its risk-adjusted returns. Gold’s unique characteristics can help smooth out your portfolio’s ride during market ups and downs.

3. Potential Returns of Gold

Potential Returns of Gold

Gold has a rich history as an investment, with its price fluctuating over time in response to a complex interplay of factors. Let’s explore the historical performance of gold investments and the key drivers that influence its price movements:

Historical Performance: Over the long term, gold has generally performed well as an investment. Historically, gold’s price has tended to rise during periods of economic uncertainty and inflation. For instance, during the inflationary 1970s, the price of gold skyrocketed. However, it’s important to note that gold’s returns can vary significantly over shorter time frames.

Factors Influencing Price Fluctuations: Several factors can influence gold’s price fluctuations. Economic and political events, such as recessions, geopolitical crises, and changes in government policies, can impact investor sentiment and drive gold’s price. Additionally, supply and demand dynamics, central bank actions, and currency fluctuations can also play a role in determining gold’s value.

Understanding Gold’s Price Drivers: To make informed investment decisions, it’s essential to understand the factors that drive gold’s price. By keeping an eye on economic and political developments, supply and demand trends, and the broader financial landscape, you can better anticipate potential price movements and make strategic investment decisions.

4. Risks and Considerations of Gold Investment

Risks and Considerations of Gold Investment

While gold offers potential advantages, it’s essential to be aware of the risks and considerations associated with gold investments:

Price Volatility: Gold’s price can be volatile, experiencing significant fluctuations in both directions. This volatility can make it challenging to predict short-term returns and can lead to potential losses if the price drops suddenly.

Storage Costs: Storing physical gold can involve costs, such as safety deposit box fees or the expenses associated with storing gold in a vault. These costs can eat into your potential returns, especially if you’re investing in smaller quantities of gold.

Liquidity Concerns: Gold is not as liquid as some other investments, such as stocks or bonds. This means that it may not be easy to sell your gold quickly, especially in large quantities, without potentially impacting the price you receive.

Other Considerations: Before investing in gold, consider factors such as the costs associated with buying and selling, the potential impact of inflation on your returns, and the tax implications of gold investments. It’s also important to remember that past performance is not always indicative of future results.

5. Different Ways to Invest in Gold

Different Ways to Invest in Gold

There are several ways to gain exposure to gold as an investment. Here are some popular methods:

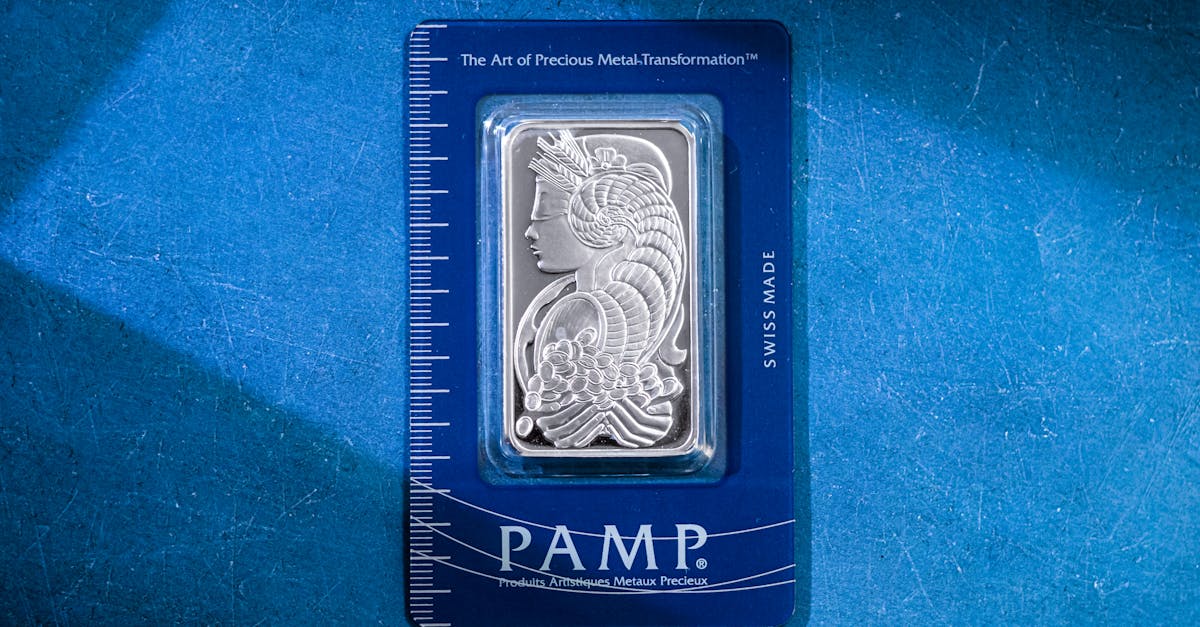

Physical Gold: Buying physical gold in the form of coins, bars, or jewelry is a straightforward way to invest in the precious metal. You can purchase physical gold from dealers, banks, or online platforms. However, storing and insuring physical gold can involve additional costs and security considerations.

Gold ETFs: Gold ETFs (exchange-traded funds) are investment funds that track the price of gold. They offer a convenient way to invest in gold without the need for physical storage. Gold ETFs are traded on stock exchanges, providing liquidity and allowing investors to buy and sell shares easily.

Gold Futures: Gold futures are contracts that obligate the buyer to purchase a specific amount of gold at a set price on a future date. Trading gold futures involves a higher level of risk and is typically suited for experienced investors. Futures contracts are traded on futures exchanges and can be used for hedging or speculative purposes.

6. Diversification Strategies with Gold

Diversification Strategies with Gold

Incorporating gold into a diversified investment portfolio can potentially help manage risk and enhance returns. Here’s how you can use gold as part of your diversification strategy:

Strategic Asset Allocation: Determine the appropriate allocation of gold within your overall portfolio based on your risk tolerance, investment goals, and time horizon. Consider factors such as your age, financial situation, and investment experience. A financial advisor can assist you in determining an appropriate asset allocation strategy.

Tactical Asset Allocation: Adjust the allocation of gold in your portfolio over time based on market conditions and your investment outlook. For instance, you may increase your gold allocation during periods of economic uncertainty or geopolitical instability.

Risk Management: Gold’s potential role as a safe haven asset can help reduce the overall risk of your portfolio. By adding gold to your mix of stocks, bonds, and other investments, you aim to create a more balanced and resilient portfolio that can potentially weather market downturns.

7. Gold Investment Tips for Beginners

Gold Investment Tips for Beginners

If you’re considering investing in gold, here are some practical tips to help you get started:

Do Your Research: Before investing in gold, take the time to educate yourself about the gold market, its price drivers, and the different ways to invest in gold. This will help you make informed investment decisions.

Due Diligence: When buying physical gold, choose reputable dealers and verify the authenticity of the gold you’re purchasing. Consider getting a certificate of authenticity or having the gold assayed to ensure its purity.

Understand the Risks: Gold investments are not without risks. Understand the potential for price volatility, storage costs, and liquidity concerns before investing. Consider your investment goals, risk tolerance, and time horizon when making investment decisions.

Is gold a good investment for beginners?

Gold can be a suitable investment for beginners looking to diversify their portfolio and potentially hedge against market volatility. However, it’s essential to understand the risks involved, including price fluctuations and potential storage costs.

What is the best way to invest in gold?

The best way to invest in gold depends on your individual circumstances and investment goals. Physical gold, gold ETFs, and gold futures are all viable options, each with its advantages and considerations.

How much gold should I invest in?

The appropriate allocation of gold in your portfolio depends on your risk tolerance, investment goals, and time horizon. Consider seeking advice from a financial advisor to determine a suitable asset allocation strategy.

Is it better to invest in gold or silver?

Gold and silver are both precious metals with unique characteristics. Gold is generally considered a more stable and liquid investment, while silver can be more volatile and has industrial applications. The choice between gold and silver depends on your investment objectives and risk tolerance.

What are the risks of investing in gold?

The primary risks of investing in gold include price volatility, storage costs, and liquidity concerns. Gold’s price can fluctuate significantly, and storing physical gold can involve additional costs and security considerations.

Essential Insights: Gold Investment

Table of Key Insights: Gold Investment

| Key Insight | Description | |—|—| | Diversification Benefits | Gold can diversify a portfolio and potentially reduce overall risk due to its low correlation with other asset classes. | | Inflation Hedge | Gold has historically served as a hedge against inflation, as its price tends to rise during periods of rising inflation. | | Safe Haven Asset | Gold is often considered a safe haven asset, attracting investors during times of economic uncertainty or geopolitical instability. | | Price Volatility | Gold’s price can be volatile, influenced by supply and demand dynamics, economic events, and central bank actions. | | Storage Considerations | Storing physical gold can involve additional costs and security concerns, while gold ETFs and futures offer more convenient storage options. | | Liquidity | Gold is less liquid than some other investments, and selling large quantities quickly may impact the price received. | | Strategic Allocation | Gold should be incorporated into a portfolio based on individual risk tolerance, investment goals, and time horizon. | | Tactical Allocation | Gold allocation can be adjusted over time based on market conditions and investment outlook. | | Due Diligence | Thorough research and due diligence are crucial when investing in gold, especially when purchasing physical gold. | | Risk Management | Gold’s potential risks should be carefully considered, and investments should be made in line with one’s risk tolerance. |

Leave a Reply